Full Count VCI

+7

Square_Frame_Ramly

cccc

BigGuy219

TheBig6

PeteBrowningFan

fisherboy7

ItsOnlyGil

11 posters

Page 1 of 2

Page 1 of 2 • 1, 2

Full Count VCI

Full Count VCI

This very well may be a bad idea, but it has to get out of my head. So, you have inherited it!

We could collectively buy a card which we think has good upside, mainly for the fun, comraderie, and perhaps to also generate a little profit.

http://www.cardtarget.com/cgi-bin/ct_checklist.cgi

Heck, we could have two "teams" compete for bragging rights. Or more.

Any thoughts, improvements, interest?

We could collectively buy a card which we think has good upside, mainly for the fun, comraderie, and perhaps to also generate a little profit.

http://www.cardtarget.com/cgi-bin/ct_checklist.cgi

Heck, we could have two "teams" compete for bragging rights. Or more.

Any thoughts, improvements, interest?

ItsOnlyGil- Retired

- Posts : 1145

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Card Target is an interesting idea, but I'm not sure how successfully it applied a stock market concept to baseball cards. A huge part of the enjoyment of collecting cards is actually holding them, looking at them, enjoying their physical presence in one's collection. How fulfilling could it be to own 1/300th of a PSA 9 T206 Lajoie? Not very, at least to me.

That said, Gil, let me see if I understand what you are suggesting here. Were you looking at the cardtarget list as a potential buying opportunity? Or were you suggesting that we collectively purchase a card elsewhere (one with good "investment potential") and split it up on our own? If it's the latter, then there could be something to that.

Whenever I hear about Card Target, I always think about the Simpsons episode when Bart, Millhouse, and Martin purchased Radioactive Man #1 and attempted to split it 3 ways. And we all know how that experiment ended

That said, Gil, let me see if I understand what you are suggesting here. Were you looking at the cardtarget list as a potential buying opportunity? Or were you suggesting that we collectively purchase a card elsewhere (one with good "investment potential") and split it up on our own? If it's the latter, then there could be something to that.

Whenever I hear about Card Target, I always think about the Simpsons episode when Bart, Millhouse, and Martin purchased Radioactive Man #1 and attempted to split it 3 ways. And we all know how that experiment ended

Re: Full Count VCI

Re: Full Count VCI

It is an intriguing concept, but I think that no one involved should have a "need" for it. That may seem tough, but there are rare issues that don't "do it" for everyone (mine would be E107)  . It's good to brainstorm Gil; count me in.

. It's good to brainstorm Gil; count me in.

Shannon

. It's good to brainstorm Gil; count me in.

. It's good to brainstorm Gil; count me in.Shannon

PeteBrowningFan- Major Leaguer

- Posts : 33

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Sounds like a fun adventure, I would like to start the conversation about which card to buy. We could always take inspiration from the Present Full Count Logo and get a high grade 6ish. Green Cobb Portrait.

Re: Full Count VCI

Re: Full Count VCI

Let's all get a home equity loan and get a T206 Wagner.

BigGuy219- All-Time Greats Champion

- Posts : 717

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

The intent here is to have fun.

To me, what would be most fun is to have selected several cards, and watch how they perform. Making continued buying and selling choices as appears indicated. But the thrust would be profit generation, not card preferences.

In order to fund individual purchases ownership shares (like CardTarget) in individual cards could be offered. Participants would opt to buy these shares, if they saw potential, and wanted to play.

There may be no interest. There could be lots.

But if one possible selection is a green 6 Cobb, you could be talking about a 1/50th ownership share costing $250. Even if some participants buy multiples, it could be difficult to fund that purchase on Full Count.

Alternate approaches are apparent. These include shopping for good buys in order to make quick flips to generate profit. And pitting teams against each other in a profit generation based competition.

What ideas do you have?

To me, what would be most fun is to have selected several cards, and watch how they perform. Making continued buying and selling choices as appears indicated. But the thrust would be profit generation, not card preferences.

In order to fund individual purchases ownership shares (like CardTarget) in individual cards could be offered. Participants would opt to buy these shares, if they saw potential, and wanted to play.

There may be no interest. There could be lots.

But if one possible selection is a green 6 Cobb, you could be talking about a 1/50th ownership share costing $250. Even if some participants buy multiples, it could be difficult to fund that purchase on Full Count.

Alternate approaches are apparent. These include shopping for good buys in order to make quick flips to generate profit. And pitting teams against each other in a profit generation based competition.

What ideas do you have?

ItsOnlyGil- Retired

- Posts : 1145

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

If we decided to go for a Cobb, might be wise to get something scarcer than a green portrait.

Maybe.....something like this?

edited to add: I think shopping for good buys on quality cards is the best approach. The group could combine resources and base buying decisions on consensus. Setting out to buy with a particular card in mind won't be as successful in maximizing "potential".

Full Count has a number of features that could be very useful to such a group if formed. Namely, the creation of a usergroup. After a usergroup is created, we have the option of creating a subforum visible only to members. This would allow group members the necessary privacy and freedom to pitch potential targets, conduct polls, post scans, and maintain finances.

Maybe.....something like this?

edited to add: I think shopping for good buys on quality cards is the best approach. The group could combine resources and base buying decisions on consensus. Setting out to buy with a particular card in mind won't be as successful in maximizing "potential".

Full Count has a number of features that could be very useful to such a group if formed. Namely, the creation of a usergroup. After a usergroup is created, we have the option of creating a subforum visible only to members. This would allow group members the necessary privacy and freedom to pitch potential targets, conduct polls, post scans, and maintain finances.

Re: Full Count VCI

Re: Full Count VCI

we have too many rich elitists here that want the card all to themselves, good idea but it won't come to fruition  . i volunteer to hold all of fullcount's cards though.

. i volunteer to hold all of fullcount's cards though.

cccc- Hall of Famer

- Posts : 2550

Trader Points :

Gil...

Gil...

I re-read the whole concept and i like the idea. I agree with Ben that we should go after a more rare card than the T206 Green portrait.

I think we would need like 10-15 guys though. Lets keep talking about this.

Mark

I think we would need like 10-15 guys though. Lets keep talking about this.

Mark

Square_Frame_Ramly- FC NCAA Bracket Champ

- Posts : 2773

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

This is certainly a rare Cobb I bet if stored away a bit could be resold with a reputable auction house with a big upside.

BigGuy219- All-Time Greats Champion

- Posts : 717

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

BigGuy219 wrote:Let's all get a home equity loan and get a T206 Wagner.

That would require "positive" equity in your home, in which I have none thanks to the booming housing market. JOY!

crazylocomerk- KOTTON King

- Posts : 2742

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

I would also like to add that I would be interested in doing something like this.

crazylocomerk- KOTTON King

- Posts : 2742

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

I can take a $1000. and put it into an AmTrust bank CD at 3.75% for nine months. Guaranteed. 0% risk (FDIC insured).

If I am to take on some risk, there has to be compensating reward potential.

I have just seen baseball cards (e107) fall about 70%. That is a real risk.

Therefore, in order for me to invest in baseball cards there has to be a real potential for profit. This potential has to be at least triple what I can get from a bank. And has to based on measurable upside rational. That is, there has to be a real reason why the card is expected to gain in value.

I consider Cobb cards as blue chip investment vehicles. As such, I expect them to generally increase in value along with the baseball card market. I do not consider them to be overpriced nor underpriced with relation to the rest of the cards in this market.

So, if you want to sell me on the merits of a Cobb card, I will be looking for reasons why that card is expected to outperform (percentage increase) other card options which are available.

**************************************************************

Here is what I want to sell you on. I have no vested nor other interest in these cards. Actually, I do not like them, other than as an option with profit potential. These are e107s. Specifically PSA1 commons and HOF rookies. I believe that both have overcorrected, and will see a short term readjustment.

In another thread the decrease in the value of e107 commons which grade poor has been explored and partially documented. HOF rookie cards also did not perform well at REA, nor did other star cards. A Jimmy Ryan 1.5 with reasonable appearance, sold for $900. And a Herman Long 1 which also presented well, sold for $700.

But those are not HOF rookies. Jimmy Collins, Elmer Flick, Joe McGinnity, and Jack Chesbro; I believe are HOF rookies in the e107 set which sold at REA.

The Jimmy Collins was a 2 and sold at $3750.

The McGinnity, a 1, sold for $4500.

these aren't too bad, the Collins is a bit weak.

Chesbro went for $2750 in a not very presentable 1 - this is not good.

And the Flick in similarly not very presentable 1 condition sold for $1600.

Sixteen hundred dollars is about the price of a PSA1 common (not a HOF rookie) before the auction!

Since all of the cards sold "at once", the price of one or more cards could not affect the others in the REA auction. Therefore, it is believed that the price each e107 attained was virtually independent of the prices which the other cards were achieving. Therefore, it is considered that a shift in the valuation of this set has occured. And imho, this shift is an overreaction to its driving forces. And an upward correction of these values is imminent.

There is a not very presentable e107 HOF rookie card closing on Thursday in the Brokleman/Luckey Auction. It is the card of Fred Clark. It will be interesting to see how that does. Based on the above I would expect it to perform much like the Flick.

Sit back, enjoy - its all for fun!

If I am to take on some risk, there has to be compensating reward potential.

I have just seen baseball cards (e107) fall about 70%. That is a real risk.

Therefore, in order for me to invest in baseball cards there has to be a real potential for profit. This potential has to be at least triple what I can get from a bank. And has to based on measurable upside rational. That is, there has to be a real reason why the card is expected to gain in value.

I consider Cobb cards as blue chip investment vehicles. As such, I expect them to generally increase in value along with the baseball card market. I do not consider them to be overpriced nor underpriced with relation to the rest of the cards in this market.

So, if you want to sell me on the merits of a Cobb card, I will be looking for reasons why that card is expected to outperform (percentage increase) other card options which are available.

**************************************************************

Here is what I want to sell you on. I have no vested nor other interest in these cards. Actually, I do not like them, other than as an option with profit potential. These are e107s. Specifically PSA1 commons and HOF rookies. I believe that both have overcorrected, and will see a short term readjustment.

In another thread the decrease in the value of e107 commons which grade poor has been explored and partially documented. HOF rookie cards also did not perform well at REA, nor did other star cards. A Jimmy Ryan 1.5 with reasonable appearance, sold for $900. And a Herman Long 1 which also presented well, sold for $700.

But those are not HOF rookies. Jimmy Collins, Elmer Flick, Joe McGinnity, and Jack Chesbro; I believe are HOF rookies in the e107 set which sold at REA.

The Jimmy Collins was a 2 and sold at $3750.

The McGinnity, a 1, sold for $4500.

these aren't too bad, the Collins is a bit weak.

Chesbro went for $2750 in a not very presentable 1 - this is not good.

And the Flick in similarly not very presentable 1 condition sold for $1600.

Sixteen hundred dollars is about the price of a PSA1 common (not a HOF rookie) before the auction!

Since all of the cards sold "at once", the price of one or more cards could not affect the others in the REA auction. Therefore, it is believed that the price each e107 attained was virtually independent of the prices which the other cards were achieving. Therefore, it is considered that a shift in the valuation of this set has occured. And imho, this shift is an overreaction to its driving forces. And an upward correction of these values is imminent.

There is a not very presentable e107 HOF rookie card closing on Thursday in the Brokleman/Luckey Auction. It is the card of Fred Clark. It will be interesting to see how that does. Based on the above I would expect it to perform much like the Flick.

Sit back, enjoy - its all for fun!

ItsOnlyGil- Retired

- Posts : 1145

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

ItsOnlyGil wrote:

But those are not HOF rookies. Jimmy Collins, Elmer Flick, Joe McGinnity, and Jack Chesbro; I believe are HOF rookies in the e107 set which sold at REA.

The Jimmy Collins was a 2 and sold at $3750.

The McGinnity, a 1, sold for $4500.

these aren't too bad, the Collins is a bit weak.

Chesbro went for $2750 in a not very presentable 1 - this is not good.

And the Flick in similarly not very presentable 1 condition sold for $1600.

Gil, I'm not sure where you got your numbers. Maybe you are looking at the prices without the 17 1/2% buyer premium.

(1) Chesbro sold in REA for $3231. Previously the same card sold in April 2007 Mastro for $4467.

(2) McGinnity sold in REA for $5287. Previously the same card sold in April 2007 Mastro for $4060

(3) Flick sold in REA for $1880.

(4) Collins was not a 2 but rather a PSA 2 MK. It sold for $4406.

As far as prices for commons, did you get your numbers from VCP? Or did you do it from recollection as well? In REA, the really rough looking SGC 10 and SGC authentic cards sold for $450-700. The nicer commons in SGC 10 sold for over $1000. Is that different than what they were selling for in the past? I always thought PSA 1 and SGC 10 level commons sold for $1000 or so. Where did you find your $1600 price? In any event, I thought even $1000 was too much for poor condition commons.

psacollector- All Star

- Posts : 167

Trader Points :

i recall...

i recall...

higher grade (SGC 30-40) E107 selling for $1,300-$1,900 in REA. And i know for a fact because i bought a Callahan SGC 40 for $1,300+BP=$1,550.

Any way, i agree with Gil that the E107 cards will come back but not for 1-1 1/2 years. And thats if the economy comes back. Without a doubt, the low prices seen in REA was because of 2 factors 1) Jonathan selling so many at once 2) the economy.

I sold my Callahan last week for $1,900---which translates into a profit of around 25% after having the card for 1 month. If i were to guess, in 2006-2007 that same card would fetch $2,800-$3,000 all day long.

We are in a rutt now for vintage cards so it is a good time to buy depressed priced cards. The thing to remember is, they may have to be held on to until the market comes back.

Mark

Any way, i agree with Gil that the E107 cards will come back but not for 1-1 1/2 years. And thats if the economy comes back. Without a doubt, the low prices seen in REA was because of 2 factors 1) Jonathan selling so many at once 2) the economy.

I sold my Callahan last week for $1,900---which translates into a profit of around 25% after having the card for 1 month. If i were to guess, in 2006-2007 that same card would fetch $2,800-$3,000 all day long.

We are in a rutt now for vintage cards so it is a good time to buy depressed priced cards. The thing to remember is, they may have to be held on to until the market comes back.

Mark

Square_Frame_Ramly- FC NCAA Bracket Champ

- Posts : 2773

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Gee,

Does that mean that you do not agree that e107s are likely a good option for profit generation?

LOT 122: 1903 E107 Breisch-Williams Elmer Flick HOF Rookie

Category: Prewar Baseball Cards (1900-1941)

Bid

Description

CURRENT BID: $1,600.00

Start: 4/3/2008 12:00:00 PM EST

End: 5/4/2008 3:56:37 AM EST

Time Left For Initial Bid:

STARTING BID: $800.00

BID COUNT: 9 (Bid History)

Add to Watchlist

Email Robert Edward Auctions

Although it is true that I used actual bid values without loading them with premiums, it is also true that we are not talking about a 17% change here.

Gil

Does that mean that you do not agree that e107s are likely a good option for profit generation?

LOT 122: 1903 E107 Breisch-Williams Elmer Flick HOF Rookie

Category: Prewar Baseball Cards (1900-1941)

Bid

Description

CURRENT BID: $1,600.00

Start: 4/3/2008 12:00:00 PM EST

End: 5/4/2008 3:56:37 AM EST

Time Left For Initial Bid:

STARTING BID: $800.00

BID COUNT: 9 (Bid History)

Add to Watchlist

Email Robert Edward Auctions

Although it is true that I used actual bid values without loading them with premiums, it is also true that we are not talking about a 17% change here.

Gil

ItsOnlyGil- Retired

- Posts : 1145

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Square_Frame_Ramly wrote:I sold my Callahan last week for $1,900---which translates into a profit of around 25% after having the card for 1 month. If i were to guess, in 2006-2007 that same card would fetch $2,800-$3,000 all day long.

Hate to disagree with you Mark but I don't recall E107 commons graded 3/40 selling in the $2800-$3000 range. Maybe I've got my head in the sand? Even paying $1000 for a SGC 10 common would have been a stretch not too long ago. I wish I had kept records of the e107's I purchased 4-5 years ago. I was able to buy low grade commons in the $300-400 range at that time.

Anyways, I'd be interested in discussing Gil's initial idea further. I think there's a lot of potential there if it's organized well.

no problem...

no problem...

to diagree...thats the fun of having an opinion.

I will look for records but i am talking about at the top of the market when E107 cards were nowhere to be found and when they were found they comanded top dollar. SGC 10 were going for $1,000, SGC 20 for $1,500, SGC 30 for $2,000, and SGC 40 for $2,800. Thats at the high range and not typical of every E107. It depended on who was on the card. Also, i am talking about NON-HOF.

Gil...if you were asking me, yes, i do believe the E107 cards will come back and are a good investment. I sold mine because thats what the guy offered me and i took it. I did not want to hold on to the card for 1-2 years since i decided to make a run at M116 Blues while the market was down.

Mark

I will look for records but i am talking about at the top of the market when E107 cards were nowhere to be found and when they were found they comanded top dollar. SGC 10 were going for $1,000, SGC 20 for $1,500, SGC 30 for $2,000, and SGC 40 for $2,800. Thats at the high range and not typical of every E107. It depended on who was on the card. Also, i am talking about NON-HOF.

Gil...if you were asking me, yes, i do believe the E107 cards will come back and are a good investment. I sold mine because thats what the guy offered me and i took it. I did not want to hold on to the card for 1-2 years since i decided to make a run at M116 Blues while the market was down.

Mark

Square_Frame_Ramly- FC NCAA Bracket Champ

- Posts : 2773

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

It seems to me that we could be running into this type of analysis frequently, and one option potentially worth considering is to purchase a subscription/membership/? to VCP so that we have the basis for the required projections. I guess that their history goes back 2-3 years by now, no?

ItsOnlyGil- Retired

- Posts : 1145

Trader Points :

if....

if....

Dave S. would take $2,000 for this and its held for a few years i believe it can be sold for 50-60% profit. Its 1 of 4 graded by SGC and the highest of the 4.

http://cgi.ebay.com/1903-Breisch-Williams-E107-Monte-Cross-SGC-50-VG-EX-4_W0QQitemZ110260779789QQihZ001QQcategoryZ57993QQssPageNameZWDVWQQrdZ1QQcmdZViewItem

I know what he paid for it and it was a steal

Mark

http://cgi.ebay.com/1903-Breisch-Williams-E107-Monte-Cross-SGC-50-VG-EX-4_W0QQitemZ110260779789QQihZ001QQcategoryZ57993QQssPageNameZWDVWQQrdZ1QQcmdZViewItem

I know what he paid for it and it was a steal

Mark

Square_Frame_Ramly- FC NCAA Bracket Champ

- Posts : 2773

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Unless I'm missing something, didn't Card Target end their shares program?

James

James

Orioles1954- Major Leaguer

- Posts : 49

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Orioles1954 wrote:Unless I'm missing something, didn't Card Target end their shares program?

James

Yes they did end their program.

What is being talked about here is getting a few of us on this board together, to purchase a card or two (collectively) that has/have a great potential for profitability. The goal being, that we hopefully all make a little money. If I'm wrong, please correct me.

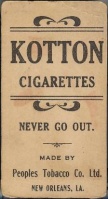

On another note, I like that Cross. Very nice high grade E107, and you gotta love the mustache. Does anyone know how many cards Monte Cross appeared on at the turn of the century? That might also help the card's value if he only appears on a card or two (I have an SGC 20 O'Connor that is the highest graded of 5 total examples between PSA and SGC, and I believe he only appeared on 2 brands of cards). It's a plus.

crazylocomerk- KOTTON King

- Posts : 2742

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Cross has a Sporting Life Cabinet, Fan Craze, E107, T206, and Lincoln Philadelphia Postcard

I would think you would even want to get a little more scarce than an e107...but who knows.

I would think you would even want to get a little more scarce than an e107...but who knows.

asphaltman76- All Star

- Posts : 200

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Gil stated above "I can take a $1000. and put it into an AmTrust bank CD at 3.75% for nine months. Guaranteed. 0% risk (FDIC insured).

If I am to take on some risk, there has to be compensating reward potential.

I have just seen baseball cards (e107) fall about 70%. That is a real risk.

Therefore, in order for me to invest in baseball cards there has to be a real potential for profit. This potential has to be at least triple what I can get from a bank. And has to based on measurable upside rational. That is, there has to be a real reason why the card is expected to gain in value".

**********************************************************

There has been a downward adjustment in the value of some, maybe all, e107 cards. And maybe not "all". Assuming that this card has a history of selling much higher than $2000; one question which eludes me is whether the downward price adjustment of this set was too great. If so, the set could experience a spike in prices in the short term which will recoup some of the paper losses observed.

If this is a fantasy, then the appreciation term which you cite, Mark, of two years must yield a total price equal to: 3.75% x 2years x triple = $2450 anticipated selling price in two years.

I find that this is quire believable.

So, lets look at the card:

The player represented is and average fielding, light hitting ss with 15 years in the NL: beginning in 1892 - so this is likely the rookie card of a common player. There is no advantage here.

The card is the highest graded by SGC of four and it is graded vg/ex. There is value here, although possibly transient. This value is the nicest card of this player - of possible interest to collectors of the e107 set. A very thin market, and a relatively unimportant card in the set.

All in all, not an overwhelming suggestion, but imho, a good one. I offer to purchase 1/8th ownership in this card for $250.

I have cash available now. If this transaction is going down, please tell me when and where to send the money.

If I am to take on some risk, there has to be compensating reward potential.

I have just seen baseball cards (e107) fall about 70%. That is a real risk.

Therefore, in order for me to invest in baseball cards there has to be a real potential for profit. This potential has to be at least triple what I can get from a bank. And has to based on measurable upside rational. That is, there has to be a real reason why the card is expected to gain in value".

**********************************************************

There has been a downward adjustment in the value of some, maybe all, e107 cards. And maybe not "all". Assuming that this card has a history of selling much higher than $2000; one question which eludes me is whether the downward price adjustment of this set was too great. If so, the set could experience a spike in prices in the short term which will recoup some of the paper losses observed.

If this is a fantasy, then the appreciation term which you cite, Mark, of two years must yield a total price equal to: 3.75% x 2years x triple = $2450 anticipated selling price in two years.

I find that this is quire believable.

So, lets look at the card:

The player represented is and average fielding, light hitting ss with 15 years in the NL: beginning in 1892 - so this is likely the rookie card of a common player. There is no advantage here.

The card is the highest graded by SGC of four and it is graded vg/ex. There is value here, although possibly transient. This value is the nicest card of this player - of possible interest to collectors of the e107 set. A very thin market, and a relatively unimportant card in the set.

All in all, not an overwhelming suggestion, but imho, a good one. I offer to purchase 1/8th ownership in this card for $250.

I have cash available now. If this transaction is going down, please tell me when and where to send the money.

ItsOnlyGil- Retired

- Posts : 1145

Trader Points :

Re: Full Count VCI

Re: Full Count VCI

Gil

Not that it matters much with this card...but it is not his rookie, the Sporting Life cabinet would be (1902).

Not that it matters much with this card...but it is not his rookie, the Sporting Life cabinet would be (1902).

asphaltman76- All Star

- Posts : 200

Trader Points :

Page 1 of 2 • 1, 2

Page 1 of 2

Permissions in this forum:

You cannot reply to topics in this forum